Indian Economy: What it means for the Startup Ecosystem?

·

Our everyday news is filled with the latest updates on the performance of the Indian economy. Everyone who has or had any business to do with India is anxious and concerned, the questions remain and are discussed regularly by business owners and investors, be it a small Kirana store owner or a major hedge fund investing in India.

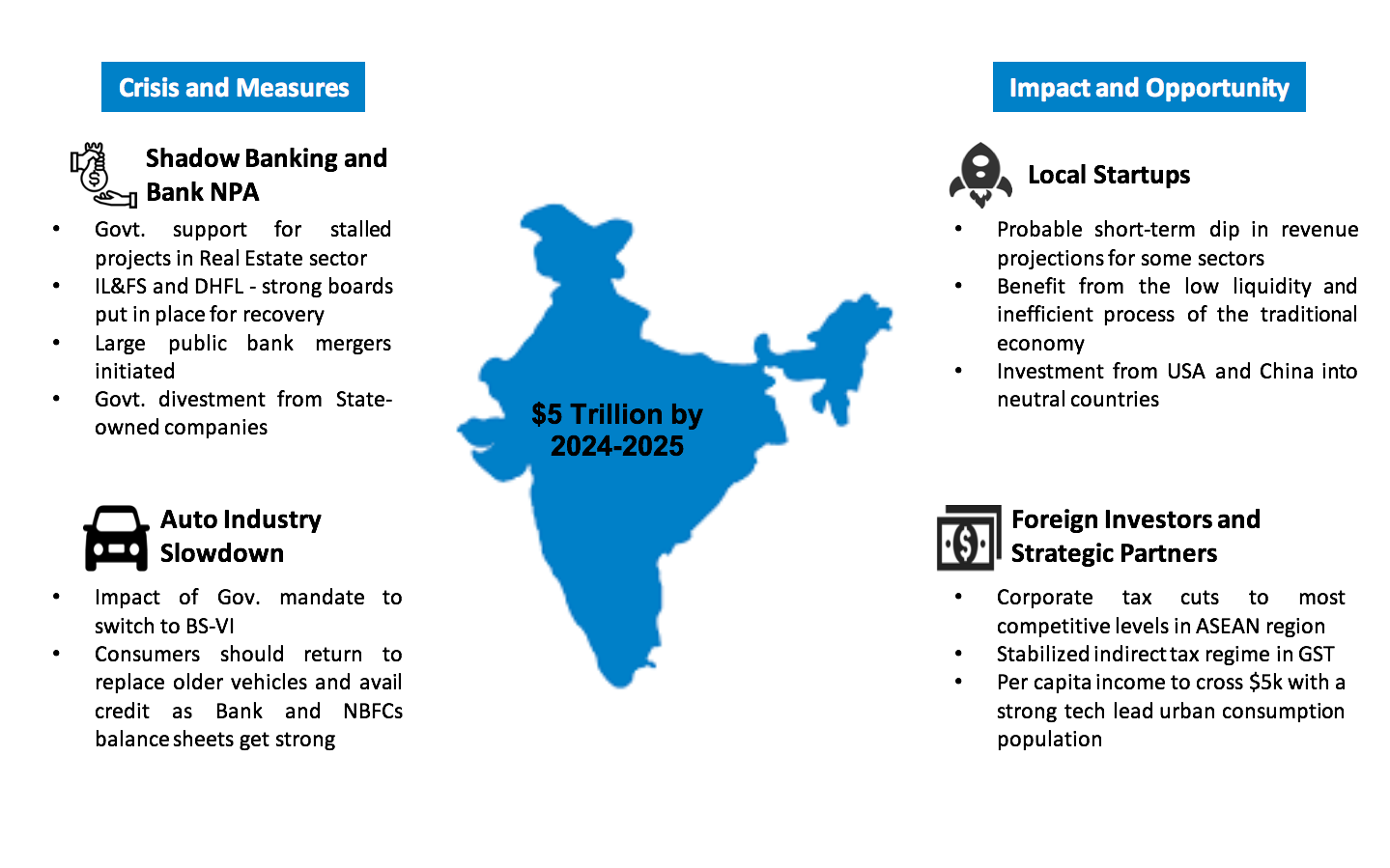

In this post, we have tried to answer some critical questions glaring at someone who has invested or looking to invest in the Indian Startup Ecosystem. We have outlined the measures taken by the Govt. and opportunities for the startups and investors. We are positive about the Indian economy and think the time is right for large investors and corporates to invest in India.

How are Shadow Banking and Bank NPA crises being resolved?

Recent resolutions of large accounts like Essar steel and Govt. announcement to support Real Estate sector stalled projects should help clean up balance sheets for Banks and NBFCs affected by it. The cascading effect of IL&FS and DHFL defaults has mostly been stalled and strong boards have been put in place for recovery. Together with large public bank mergers initiated by the government and the large margins made between retail lending rates and central bank lending rates, most Banks and NBFCs are now making significant returns and liquidity situation is improving fast.

Why is the Auto industry demand down and how will it recover?

Primarily, the weak demand in the Auto sector is due to the Govt. mandate of switching to new Fuel Efficiency Standard (BS-VI) coming into effect from April 2020. This has led to consumers and businesses delaying purchases to the release of new vehicles which will have a longer life and better resale value. Together with the pullback of NBFCs from financing riskier customer, it had a compounding effect.

The effect of the above would probably continue for another 3-6 months at which point, customers should return to replace older vehicles and also avail credit as Bank and NBFCs balance sheets get strong.

What steps is the Govt. taking?

The Govt. has taken a number of strong policy measures, the strongest of which is the Corporate Tax cuts to most competitive levels in the ASEAN region, hence attracting further investors. Other measures like divestment from State-owned companies will help balance the fiscal deficit and give the Govt. ability to perhaps bring down taxes further.

How will startups be affected?

While there might be a short-term dip in revenue projections for some startups in core sectors, in the long-run, the startups will actually benefit from the low liquidity and inefficient process of the traditional economy. As either suppliers, partners or competitors – with low leverage and strong technology products, the startups actually have the opportunity to consolidate their market positions in a market affecting traditional players. Moreover, due to the trade war between the USA and China, investors from those markets are looking to take the battle to neutral countries like India, leading to higher availability of capital for local startups.

What are the long-term prospects and are the fundamentals still strong?

India still remains the only major economy in the world growing at 5+% and even with a lower forecast will hit a $5 Trillion economy within the next decade. The per capita income will cross $5k with a strong tech-driven urban consumer. With a stabilized indirect tax regime in GST and low corporate tax structure, local enterprises and MNC will have the ability to aggregate demand and enter new markets. For investors and strategic players with a long-term outlook, this would be a great time to enter the market and explore partnerships.

Author: Brij Bhasin, GP Rebright Partners