Behind the Scenes of a Startup IPO: A Candid Conversation with Policybazaar’s Alok Bansal

·

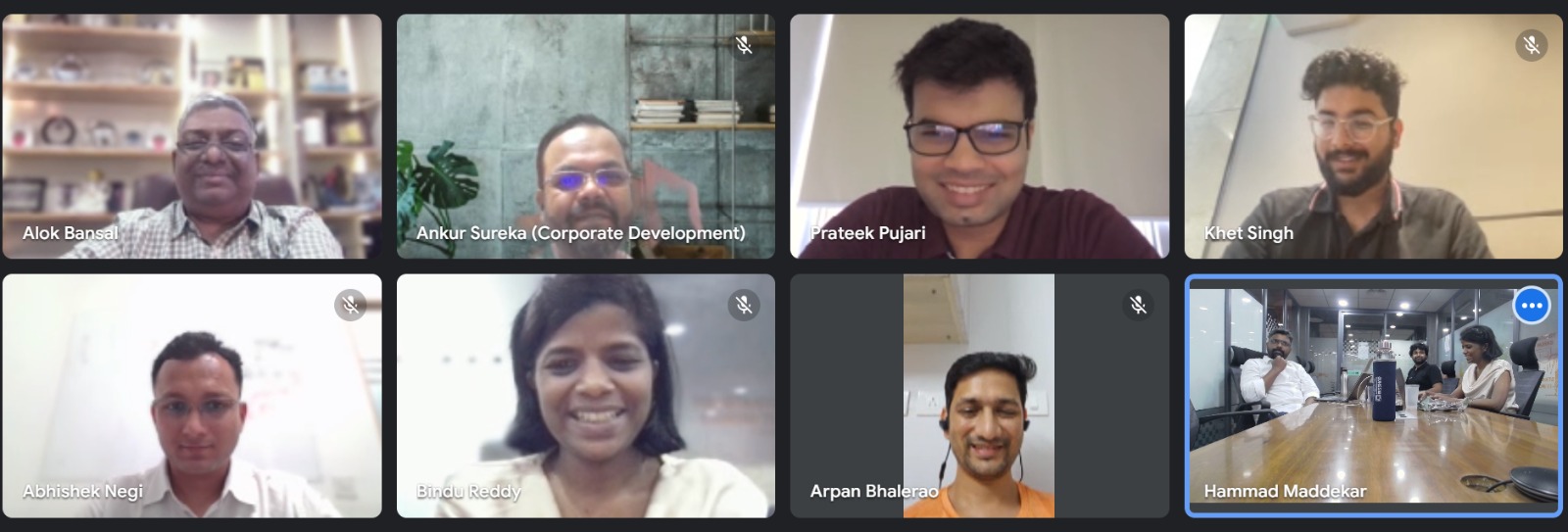

Rebright recently held an engaging session as part of our “Founder’s Forge” series, a series of intimate invite-only discussions.

The session featured Alok Bansal, the CFO of Policybazaar, as the guest speaker. As a key player in the successful IPO of Policybazaar in the Indian market, Alok brought a wealth of firsthand experience and insights to our event.

Founders and KMP from our portfolios namely, Medibuddy, Claimbuddy, Niro, Eggoz, Aquaconnect, Bulk MRO, and Lets Transport attended the session.

The session was specifically tailored to our late-stage and growth-stage startups and provided a deep dive into the intricacies of taking a startup public in India. Attendees had the unique opportunity to hear from someone who has been at the forefront of navigating the complexities of the Indian IPO landscape.

Alok Bansal shared his journey with Policybazaar, detailing the strategic and operational steps the company took to prepare for an IPO. He emphasized the importance of a strong foundation in terms of governance, financial discipline, and market positioning.

Following were our key takeaways-

- Why IPO and the size of an IPO – It is very important to understand the “why” behind pursuing an IPO. Companies must assess if the IPO aligns with their long-term goals and whether it serves as an avenue for investor exit. Additionally, the size of the IPO, whether large or small, plays a significant role in shaping the strategy and approach for the company.

- Internal Team Alignment – Internal alignment within the team is crucial for a successful IPO journey. Startups must ensure that the entire team, from top management to operations, is on the same page regarding the vision and strategy. Clear communication and coordination across all departments will streamline the process. The right team should be hired as the team which helped the company for 1 to 10 Journey may not be the right fit to take the company IPO.

- Conducting Pre-IPO Feasibility Tests – Before moving forward, startups should conduct an internal feasibility study to evaluate their readiness for an IPO. Alok recommended engaging a third-party agency for an independent feasibility study, providing an objective perspective and ensuring thorough preparation for the IPO journey.

- Establishing a Separate Board for IPO – Setting up a separate board for the IPO process is another key consideration. This dedicated board can oversee the IPO-related activities, offering focused expertise and guidance. A specialized board can help manage the unique challenges and opportunities of taking the company public.

The session concluded with a Q&A session, where attendees had the opportunity to ask Alok questions specific to their own startup journeys. His candid responses and actionable advice left attendees feeling inspired and equipped with valuable knowledge.

As we continue our “Founder’s Forge” series, we are committed to bringing together industry experts and thought leaders to guide and support our portfolio companies.

Stay tuned for more exciting events in our “Founder’s Forge” series as we strive to empower the next wave of entrepreneurial success in India!

We thank all the attendees and Alok for their valuable time.